A fixed asset register is a key way for businesses of all sizes to accurately record their assets and the value of those assets. Keeping track of assets is vital for several reasons, including preventing theft, and accurately reporting the declaration of any company assets. Reporting inaccurate information on fixed assets could impact business decisions, so it’s important to understand the place and value a fixed asset register has in an organisation.

This content is covered in our AAT Level 3 Advanced Diploma and AAT Level 4 Professional Diploma which forms essential knowledge and skills for a successful career as a junior accountant or bookkeeper.

What is a fixed asset?

In accounting terms, a fixed asset is something that a business uses to create income, meet debt, grow business wealth and attract and retain customers. A fixed asset can be a variety of items, such as land, buildings, furnishing, IT equipment etc.

What is a fixed asset register?

A fixed asset register is an accounting tool used to keep lists of various assets that a business owns and is used to summarise both accounting and depreciation expenses. The fixed asset register will typically include details about the assets, such as:

- What it is

- Where it is located

- Purchase price

- Date of purchase

- Life of the asset within the business

- Depreciated value of assets after a particular point in time

- Expected value at the end of its useful life

The purpose of maintaining a fixed asset register is to keep track of the book value of assets and depreciation charged over a period of time. A fixed asset register is also a useful means of easily identifying the items within the business by assigning each item a unique identification number or code.

Benefits of fixed asset registers

Creating and maintaining a fixed asset register has many benefits for a business:

- To meet statutory requirements

- Track and identify the asset

- Prevent theft of assets

- Calculate depreciation annually

- Track gross book value and the net value of assets

- Assists in conducting an audit of assets and asset verification

- Helps in estimating the repairs and maintenance cost

- Assists in estimating the future capital investment in fixed assets

- In certain countries, subsidies are allowed on certain assets. The value of assets is determined by fixed asset registers

- Determining the value of the business

Maintaining a fixed asset register

A fixed asset register can be maintained using a spreadsheet or accounting software. How you choose to format it depends on the size and needs of your business.

It’s recommended that you update the fixed asset register whenever you acquire a new asset, and when you dispose of an asset. The amount of work this entails will depend on how big your company is and how many assets there are to keep track of.

Keeping on top of updating your register will certainly save time and stress when it comes to auditing at the end of the financial year.

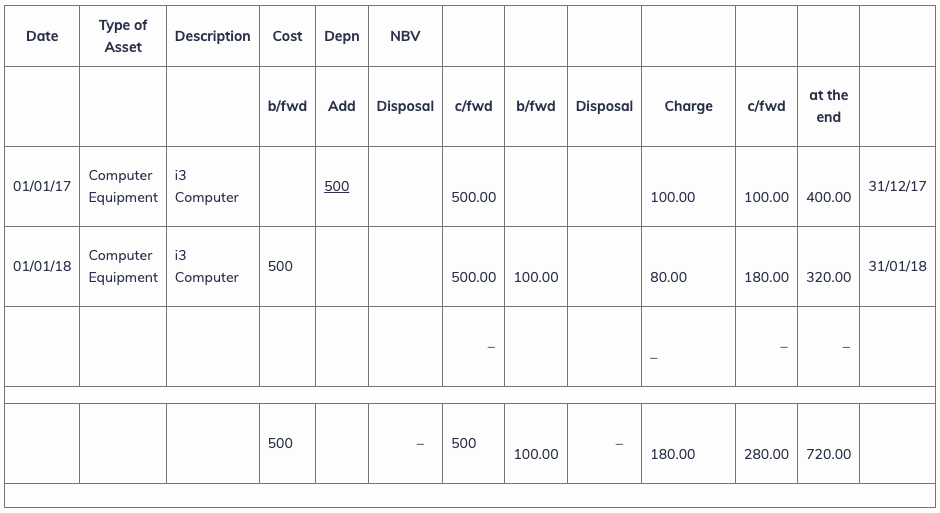

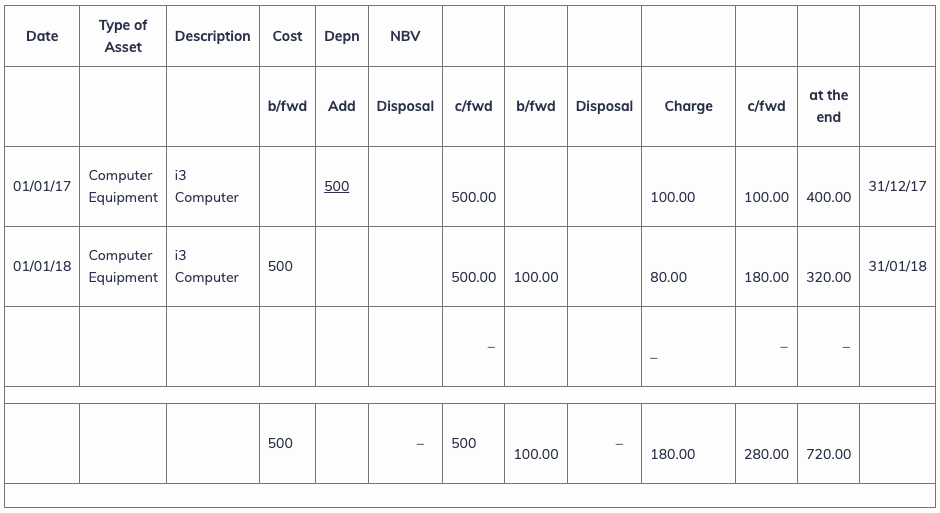

Fixed asset register example

Below is an example of a fixed asset register with the purchase of a computer for the value of £500 on 01/01/2017. The rate of depreciation charge is 20% for the first year and thereafter 20% RBM on it. Year-end is 31.12.2017.

Summary

A fixed asset register is an essential and valuable tool for any organisation. It not only helps keep track of the value of its fixed assets, but it can also help a business to understand its overall value from fixed assets such as land, building, vehicles etc it owns.