We all know how much we get paid, and how much we would have got if we hadn’t paid tax and National Insurance. Now let’s take a look at how to account for wages in control accounts.

Gross pay

Let’s start by working out what makes up gross pay, which is the total amount we would get paid if we didn’t have any deductions.

Gross pay can be made up of basic pay, holiday pay, and possibly statutory payments like sick pay. It’s the total amount the company pays out, and is the cost of having employees. Gross pay is classed as an expense for the business.

Additional costs of having staff

Gross pay is just the starting point, and there are other costs associated with employing staff.

One of these additional costs is the National Insurance contributions that the business has to make. This is also a business expense.

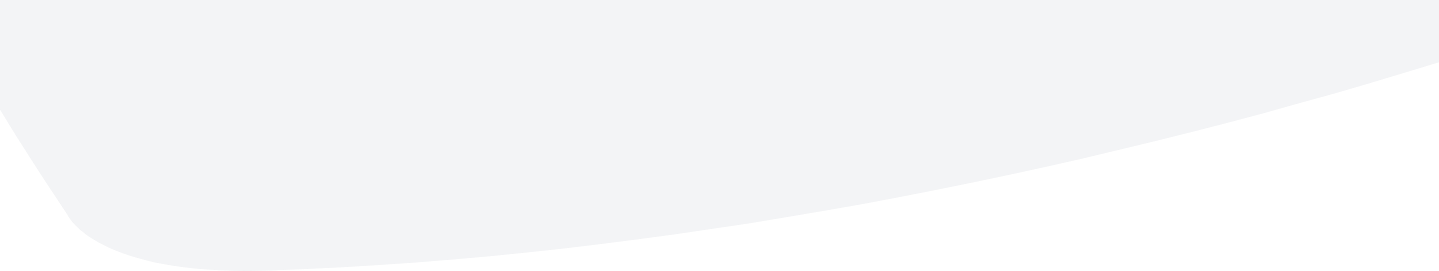

According to the rules of double entry bookkeeping, when we increase an expense we need to debit the expense account. For every debit entry, there must be a corresponding credit entry. The credit entry in this case will be to the wages control account, which is a liability account. In line with double entry, when a liability account is increased, we credit it:

Deductions

As we are aware from our payslips, we don’t get paid the gross amount. The company must make deductions from the gross pay, which are then paid to the relevant parties.

These deductions can include:

- PAYE – which needs to be paid to HMRC

- National Insurance – which again needs to be paid to HMRC

- Other payments, such as healthcare – this needs to be paid to the health care provider

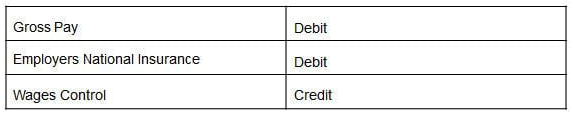

Any deductions made from the gross pay will need to be accounted for in the accounts. The debit entry will be to the wages control account, as we are reducing the liability (we are reducing the amount that we owe to staff).

We then need a credit entry, crediting the account that we owe the money to. So, for example, the PAYE will be credited to the PAYE account, as we now owe them the money.

Remember, included in the wages control account will be the employer’s National Insurance contribution. This is not owed to the staff member, but to HMRC, so this needs to be debited to the wages control account, and credited to the PAYE account:

Paying staff

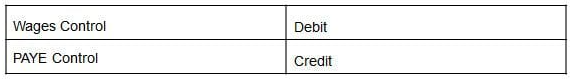

The final step of dealing with wages in control accounts is to actually pay the staff.

The wages control account balance should reflect the amount that is due to be paid to all staff. We increased it (credited it) with the gross pay, and then decreased it (debited it) with any deductions made: the balance remaining will be the amount to pay.

The double entry for the payment will be to credit the bank as we are reducing the asset, and debit the wages control account as we are reducing the liability:

Dealing with wages in control accounts is covered in further detail on our AAT courses, which can be studied at your own pace with full tutor support.

Want to become a qualified accountant?

Learn More