Organisation is the key to good bookkeeping. Knowing what invoices have been received, what invoices have been sent, what has been paid, and what is waiting to be paid, will enable you to manage finances more effectively, and have a better chance of maintaining a positive cashflow.

This information needs to be readily available, and in a format that anyone can read. This means that all source documents need to be written up into a daybook, and from here entered into the accounts.

The source documents need to be filed and the daybooks need to be formatted to enable key information to be obtained quickly.

Let’s take a look at daybook format for the different types of daybook you will be using.

Types of daybook format

There are 6 main types of daybook:

- A sales daybook to record sales invoices

- A sales returns daybook to record sales credit notes

- A purchase daybook to record purchase invoices

- A purchase returns daybook to record purchase credit notes

- A payments cashbook to record monies paid out of the business

- A receipts cashbook to record monies paid into the business

Daybook format: columns

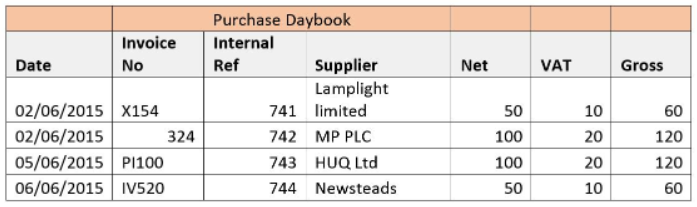

All the daybooks will have slightly different requirements, but all will need to record the key information in a column format.

The columns that need to be included are:

- Date – A date is always important for accountants: consider which financial year it falls into, which VAT return it falls on etc.

- Invoice number – This is the reference to the source document. It enables you to quickly find the original document that should be filed away.

- Customer/supplier name – This enables you to see which customers you have invoices for (and who you should be chasing), or which suppliers you owe money to.

- Net amount – This is the actual amount of the sale or purchase, and will be recorded in the accounts.

- VAT amount – This is the amount of VAT that is due to be paid over or reclaimed.

- Gross amount – This is the amount that will be received or paid out of the bank, depending on whether it is a sales or purchase daybook.

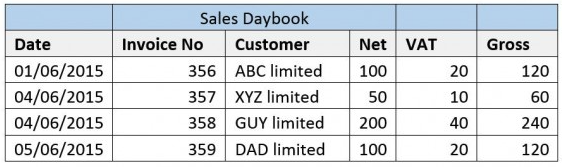

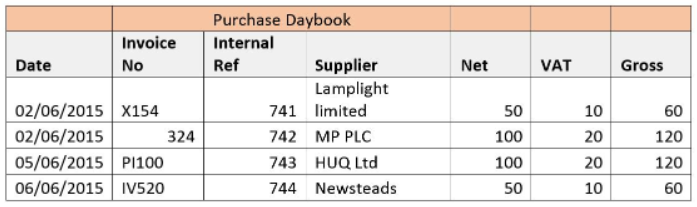

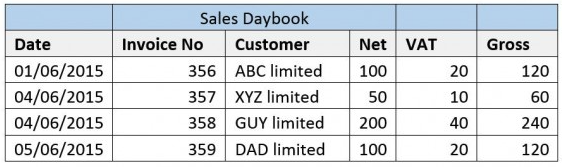

Daybook format examples

Here are a couple of examples of daybook formats, so you can make sure you’re doing it right.

Sales daybook:

Purchase daybook:

Daybooks are covered in more depth within the AAT qualification. To find out more about developing your career as a bookkeeper or accountant, get in touch below.